Why do we flip coins ? Random draws as personal decision-making devices under uncertainty

By Bahador Bahrami and Ophelia Deroy

***

– For my undergraduate, I was completely undecided between medicine and engineering. I liked both and could not make up my mind.

– How did you decide?

– I flipped a coin. Heads for medicine and tails for engineering.

– You did not!

– I did. The coin landed on tails and I heard myself thinking, “Let’s do best of three”. And that is how I realized what I really wanted.

– By doing the best of three?

– Of course not. There was no need anymore. I knew I wanted to do medicine.

Why would anyone defer to a random process, such as flipping a coin, to take personal decisions? Most often, the practice is attributed to superstition, worthy only of those who, like Donald Duck, carry their ‘lucky penny’ around. In popular culture, coin flipping is favoured by criminals and sociopaths, who use it to display their indifference toward the fate they will inflict to their victims (see Figure 1). These conceptions miss the idea conveyed in the conversation [1] quoted above: that a random draw can act as a useful personal decision-making device in situations of uncertainty. One of the few experimental studies conducted on the matter [2] by Freaknomics presenter Steven Levitt suggests that people who decide to make a change in their lives derive extra-happiness if it is consistent with what a previous coin flip recommended them to do.

Figure 1. Supervillain Anton Chigurh offers a coin toss

to his victim, in Joel and Ethan Coen’s movie

“No country for old men”.

True, relying on a random draw might betray a sort of wishful deference to a higher-causality, as it does in many divination practices. Take for instance the extremely common and respectfully regarded practice of Estekhāre in Shiite Muslim cultures [3]:

A distinguished clergyman with an ostentatiously random mannerism draws a verse from the Holy Koran and immediately interprets it as “good”, “middle” or “bad” to guide the undecided believer with his/her dilemma. Very often, the clergyman is not even interested in knowing what the dilemma is about but nonetheless goes about drawing God’s verdict which is, in turn, taken up with much gratitude and respect and often repaid for with handsome gifts. Consulting religiously themed randomizers is not restricted to Muslims. In Sensoji temple at Asakusa in Tokyo, visitors afflicted by indecision can consult the divine wisdom by purchasing an Omikuji paper fortune. The process is diligently and conspicuously randomized. The paper fortunes are organized in a long library of numbered drawers. (see Figure 2) The customer starts by blind-drawing a metal straw from a bunch of straws of various lengths and then goes to the drawer indicated by the straw length to pick up her/his fortune. Similar to the Shiite tradition, the Omikuji fortune message has two parts: an abstract poetic part and a concrete recommendation that often has a clear valence ranging from “excellent” to “extremely Bad”.

Figure 2. Omikuji paper fortune.

There might be a continuity between coin flipping in one’s privacy and the more ritualised random draws seen in divination, as Edward Burnett Tylor suggested: in both cases, individuals are prone “to suppose spiritual beings standing over the diviner or gambler, shuffling the lots or turning up the dice to make them give their answers”[4]. Neither practice, nicely enough, binds the agent to the random draw or its proffered meaning.

However, when resorting to randomness is motivated by deference to a divine authority, there is no issue in explaining why the random outcome constitutes an epistemic gain: the very act of relinquishing control over choice and delegating it to an external process turns the physical event into (coin, dice, straw, page) a meaningful one, providing information as to what the divine intentions are. Surely, the divinity is authoritative as to what the truly best option is, and what we should prefer. Similarly, deference to a divine verdict or a random draw can lower our sense of responsibility and offer a pragmatic advantage, especially if the choice turns out to be bad.

But is this the only way coin flipping can help? Even when the process considered as blind, flipping a coin can have epistemic benefits and do an uncertainty-lifting job for us.

1. Turning problems into two alternative force choices

Coins are especially popular for decision-making, much more than dice for instance. Unlike dice, coins indeed have only two faces. This material constraint forces us to re-formulate our indecision into a 2-alternative choice.By demanding that we reduce the number of options to two, the coin brings a clear epistemic benefit of simplifying the problem and decreasing our cognitive load. Having too many options is also known lead to irrational choices (e.g., Decoy Effect). In addition, our capacity to reflect on our own uncertainty is particularly informative when we are faced with two alternatives: we then better manage to track our probability of making the right choice. There is ground to suspect that this may not the case with numerous options [5].

Pruning of options is a key difference between religious rituals involving random draws to seek a divine verdict and coin flipping. In the former, the meaning of the randomly drawn outcome (the verse of the Koran, the Omikuji poem) is usually assigned after it is drawn. It is also usually generic enough to leave room for interpretation and re-interpretation. Coin flipping is much more rigid: both the question and meaning of the alternatives need to be specified before the result is known, leaving little room to interpretation: Heads means ‘medicine’, tails means ‘engineering’. The need to specify the options, and to parse them in heads or tails, can sometimes bring an epistemic progress, not about what to do, but about the structure of the problem.

2. Random walks as optimal exploration

Coin flipping might have another epistemic benefit for the way we explore solutions. If we are uninformed about the utility of two options, settling for a random exploration of one of them is possibly a wise choice. Coin flipping often occurs because we faced with two options which look as good as each other (e.g. engineering and medicine, in the conversation quoted above); however, choosing is just as difficult because we realise we know very little about the options in the first place. In the absence of prior information, random walks constitute sometimes an optimal exploration strategy.

The anthropologist Omar Khayyam Moore [6] suggested a similar interpretation of the function and survival of divination practices, taking as an example the divinatory ritual of the Naskapi people, living in the forests and barren ground of the interior plateau of the Labradorian Peninsula. The Naskapi people would clean the shoulder blade of a Caribou, and hold over hot coals for a short time. The heat causes random cracks and burnt spots to form, and these are then “read.” One of the key indications of the readings was to determine what direction should hunters take in locating game? This is a critical matter, for the failure of a hunt may bring privation or even death. Deferring to a random process, Moore argued, may be an optimal strategy for the hunters, by preventing them to follow biased preferences for certain sites. A random exploration prevents thus the over-exploitation of some the limited resources. It also makes it impossible for the hunted prey to predict the hunters’ next move : non-randomizing hunters would be more predictable for the prey and therefore easier to avoid.

Coin flipping could help similarly where random search is advantageous, and where we are repeatedly faced with similar decisions – like the Naskapi. Take on-line dating: if undecided between two people asking you on a date on the same day, you can flip a coin, making sure that your exploration of potential mates is somewhat free from biases. Eventually, this might even make it harder for the website to predict what kind of people you like – and save you from predictive algorithm reinforcing your biases by suggesting people similar to the ones you chose previously. Flipping a real coin here really matters, as humans are particularly bad at acting truly randomly (and at being genuinely unpredictable).

Figure 3: Random walks can help us out of dilemmas,

especially in Buridan’s ass cases where the two choices

look strictly equivalent (cartoon by Bahador Bahrami)

3. Revealing preferences: exploiting emotional anticipation

The two benefits above still don’t show that the coin can reduce our epistemic uncertainty about the utility of the options, unless we read some meaning into its result. However, we need to realise that coins are not only thrown when we are uncertain about which of two options is better, but because we are uncertain about our own preferences, either the immediate ones (e.g. do I want Tex-Mex or Japanese food now?) or the ones that will endure in the future (e.g. I am undecided between medicine and engineering now, but I might feel differently later). Coin flipping can then help through its capacity to “reveal preferences”. Here the random outcome may help the decision process not because it is seen as the manifestation of external forces, but because of what it triggers internally.

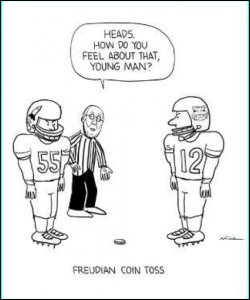

The idea that coin flipping ‘reveals preferences’ is attributed to Freud (though we have not been able to find a clear trace of this idea in his writings): somehow, we have a preference, but we’re unable to observe and acknowledge it openly. It is unclear however how this revelation is supposed to work, except if we buy into the psychoanalytic idea that we “repress” some preferences. Why a coin lifts the repression is also not very clear. To be more satisfactory, this access explanation has to explain why the flipping of the coin causes this gain in awareness. What are the cognitive and neuropsychological bases of this ‘revelation’, and how do they relate to the coin?

A more cognitively-minded description of this is idea based on the proposition that our preferences are mental/neural states that are sampled by higher order decision processes. In this view, a neural representation of our preferences is not fundamentally different from, say, the representation of our memory of our family members’ faces. We may have forgotten how a distant deceased uncle used to look like but a memory trigger (e.g. the name of that uncle’s dog) may help us remember. If an event, such as flipping of coin, sets the neural sampling process in motion or facilitates it, then it can be said to reveal our preferences to ourselves.

Figure 4. Flipping a coin may help some people

observe their own feelings better and get a clearer

idea of their own true preferences

Coin flipping can be related here to theories showing how, in many situations, our own preferences are shaped by observing our emotional responses to the choices we make [7]. Many of us have experienced how, sometimes, our heart sinks the moment we have completed a credit card payment in a retail shop. Suddenly, I feel that the trousers I just bought are not that good after all and probably not worth the price. Oddly, this feeling seems to have not been available to me throughout the 20 minutes of contemplating whether to buy the trousers or not but it became crystal clear the moment after payment. Following this analogy, the random external event of the coin landing ‘heads’ (or ‘tails’) might be able to help us trigger the same of cascade of internal mental events that constitutes the emotional response to credit card payment but without having to part with money. Here the coin does more than giving us access sampling an existing preferences – it triggers a novel emotion, which gives us new information, which might reduce the paralysing uncertainty.

A possible mechanism here comes from the well established evidence of “emotional anticipation” whose neural and cardiac signatures have been demonstrated: In psychophysiology, emotional anticipation can be investigated by means of slow cortical potentials, using a two-stimulus task, where a first stimulus (S1 or warning stimulus) indicates the occurrence of a second stimulus (S2 or imperative stimulus).[8] The Stimulus-Preceding Negativity (SPN) and the drop in heart rate occur as an anticipation of the outcome, in this case the landing of the coin – creating potentially an embodied preparation for a heightened emotional response to one or the other outcome, depending on which side the coin lands. In other words, the beauty of the coin is to create an anticipation as we toss it: We use this as a device to artificially trigger an emotional anticipation, while our heart speeds up waiting to see where it lands. The coin exploits for our own devices an ancient anticipatory mechanism which enables us to ‘feel’ more, and learn about our own preferences as if looking into a mental mirror.

4. Revealing preferences: Exploiting the virtual step in time

The additional information about our preferences need not be provided by emotion, but eventually can be triggered by a more reflective mechanism: The random result may trigger the selective cognitive simulation of one of two options. It encourages us to put ourselves into the shoes of the person we will be, having now gone from being stuck to having made one step forward toward one option. The step forward does not need to be ‘acting on the outcome’. It can be as minimal as just introducing a priority into the simulation mechanism: This self-simulation moves us away from our present undecided self, and projects us just one step forward, as if we had decided for one of the option. Here what we exploit is not the physical timing of the flipping (the anticipation of the outcome, and our emotional preparation to it) like above in (3) but its ‘virtual timing’, which allows us to selectively simulate a single future. The coin helped our friend out of his own constant flipping between simulating engineering then medicine, and coming back to engineering, etc. – eventually never fully completing the simulation of one of the options, which is necessary to realise our preferences.

Before flipping the coin, we suggest that our friend was afflicted by a ‘choice-endowment‘ effect: When presented with two options and uncertain about which one he preferred, it was difficult to let go by himself of one of the two options he had. After all, both medicine and engineering were just as appealing: he could enjoy becoming a doctor, and just as well, he could like becoming an engineer. Choice endowment is inspired by Kahneman, Knetsch and Thaler’s Endowment effect, showing that people are unwilling to let go of a valuable object given to them at the price at which they were ready to acquire it. Once we own the object, our idea of its value increases making it difficult for us to lose it. The same might apply to the options that we believe we have. In this view, having flipped the coin and observed the “engineering” outcome, our friend could finally stop contemplating the two options as things he equally had,: he could look at the unselected one as a loss and contemplate if he could live with that.

Interestingly, this suggests that the coin’s enabling powers comes not from what it recommends us to choose, but what it asks us to let go of.

[1] The authors are indebted to Joel Winston for sharing these memories and insights [2] Levitt, S. D. (2016). Heads or tails: The impact of a coin toss on major life decisions and subsequent happiness (No. w22487). National Bureau of Economic Research. [3] “60 ta dar daghigheh baraye Moslemine nadan”. (video) Youtube @jamesmajd9696. September 1, 2013. [4] Tylor. E.B. (1871) Primitive Cultures, p. 79. [5] Armand, Navajas, Bahrami & Deroy, 2017 [6] Moore, O.K. (1957). Divination : A new perspective. American Anthropologist, 59, 69-74. [7] Economists will be familiar with the idea that hypothetical preferences do not reflect actual choices. In psychology and neuroscience, see also Johansson, P., Hall, L., & Sikström, S. (2008). From change blindness to choice blindness. Psychologia, 51(2), 142-155; Sharot, T., De Martino, B., & Dolan, R. J. (2009). How choice reveals and shapes expected hedonic outcome. Journal of Neuroscience, 29(12), 3760-3765. [8] Poli, S., Sarlo, M., Bortoletto, M., Buodo, G., & Palomba, D. (2007). Stimulus-preceding negativity and heart rate changes in anticipation of affective pictures. International Journal of Psychophysiology, 65(1), 32-39.

No comments yet