Ubiquitous yet nowhere to be found: on the Invisible Hand’s success

Adam Smith’s invisible hand is a tremendously successful metaphor. Quotes abound to state how important and pervasive the idea is (and was) for both economics and social sciences at large. Yet, the invisible hand also happens to also be a remarkably ill-defined metaphor. It seems nearly impossible to find an agreement through the literature as to what the metaphor is, exactly, or which phenomena would count as occurrences of the invisible hand. I want to suggest that the lack of a precise definition was not a problem, but the precise reason why it got so successful: it offered a versatile label that could be used to refer to causal links across scales of analysis, while avoiding to commit to any more precise mechanistic explanation.

The invisible hand metaphor’s success is especially intriguing when considering how (parsimoniously) it was used by Adam Smith. It appeared in only twice in relation to economic phenomena in his works (three times in total, the last one relates to astronomy). In the Wealth of Nations, the invisible hand appears in the context of describing how the preference of a merchant to keep his wealth in his home country contributes to the greater good. In the Theory of Moral Sentiments, the metaphor seems to relate to the ‘equal’ repartition of resources results from the landlord being unable to consume the totality of what is produced on his land. There have been numerous attempts to pinpoint what was meant by Adam Smith’s uses of the invisible hand. Several authors (Kennedy, 2009; Grampp, 2000) also concur on the idea that the invisible hand was used by Adam Smith essentially as a rhetorical device, and did not imply a justificatory dimension.

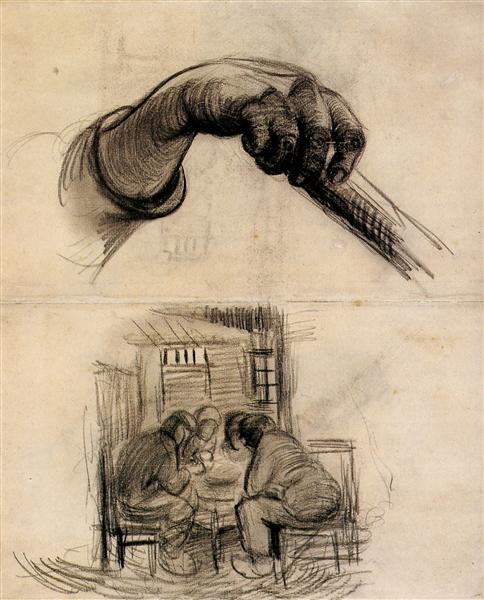

Hand with a Stick, and Four People Sharing a Meal (Vincent van Gogh, 1885)

The invisible hand metaphor did not meet success before the 1940s (see Kennedy, 2009, and Samuels, 2011), and was indeed popularized mostly by 20th century economists, who offered a large range of possible interpretations of the metaphor, and made it a scientific concept. The invisible hand has since been used, by economists and other social scientists, so with at least nine different meanings. « The invisible hand has been interpreted to mean: (1) the force that makes the interest of one the interest of others, (2) the price mechanism, (3) a figure for the idea of unintended consequences, (4) competition, (5) the mutual advantage in exchange, (6) a joke, (7) an evolutionary process, (8) providence, (9) the force that restrains the export of capital. » (Grampp, 2000, p. 450). To this list, Grampp also adds his own understanding of the invisible hand, i.e., of it then being « self-interest operating in (…) the circumstance in which a private transaction yields a positive externality that augments a public good » (p. 451). An even more extensive list of candidates to be qualified as the invisible hand can be found in the third chapter of Erasing the invisible hand (Samuels, 2011). [1] The ability of the invisible hand to fulfill any kind of epistemic role, i.e., produce any knowledge, has also been seriously called into question [2].

Then, if this metaphor is both imprecise and mostly rhetoric, how did it become so successful, and especially as a scientific concept?

I suggest that the invisible hand’s importance to economics was to be found in offering a way to acknowledge the existence of causal principles and links at play in a multitude of phenomena in economics. The invisible hand metaphor is able to fulfill this function by being a metaphor of ‘restricted’ agency, and by black-boxing different parts of the economic reasoning that are crucial but nonetheless out of economic investigation’s scope.

First, the invisible hand shows a somewhat restricted agency. It refers only to the hand, not to a full agent. The metaphor is restricted to a body part and thus to the physical action, with no form of ‘thoughtful’ planning. This contrasts with natural selection. In the case of natural selection, Darwin’s argument starts with artificial selection and with a full blown agent being responsible for the selection phenomenon – he then works his way down to an agent-less natural selection from there (Burnett, 2009). In the case of the invisible hand, the metaphor creates a relation between the intra-individual, psychological scale and the aggregated (large-scale) macro level. What is observable at the macroscopic scale seems suggestive of an underlying cause left unexplored (i.e., the invisible hand). In virtue of this particularity (being limited to the physically active part of an agent and devoid of any planning), the invisible hand metaphor stands as a ‘missing link’ or ‘missing cause’. It stands for something unknown yet necessary within the causal frame explored by economists. As such, it could be used for black-boxing a level of analysis and acknowledging the possibility, for some type of phenomena, to cause other types of phenomena.

The invisible hand metaphor seems to operate sometimes at the intra-individual level (the preference of one given merchant), or more often, between the (micro-level) individual interests and the macro-level large-scale consequences (the relation between resources repartition and the landlord’s consumption capability). Let’s go back to the meanings listed by Grampp: most of them are ambiguous about the level at which the hand is supposed to act, or imply several different levels at the same time. For instance, take the ‘force that restrains the export of capital’ or ‘competition’. Both can act on the individuals’ psychology, or via larger scale economic parameters, such as interest rates or prices of given commodities. In both cases, what the invisible hand metaphor achieves is no more (but no less!) than acknowledging the plausibility of a link between the two levels that are traditionally studied within economics (micro and macro).

Metaphors are pervasive in economics – curves drawn on chalkboards and models are metaphors to the extent that are substitutes for real-world phenomena, like markets (McCloskey, 1995). A substitution view of the metaphor’s role (Black, 1962) also implies that, by definition, finding phenomena that would be an instance of the invisible hand is an unsolvable task: the metaphor fills an otherwise empty conceptual space (also referred to as catachrèsis). These ideas for which no words seem to exist (at least in Smith’s time) are either some kind of aggregate or average of the incentives and being ‘pushed’ or ‘led’ on a behavioral course, or the effects emerging from this psychological average at macroscopic scales. Both options would have crucial roles in economic reasoning, but might not have been within the scope of what economics investigated. It black-boxed parts of economic explanations that were not relevant (for instance, detailed psychological considerations), or the precise way one scale (individual for instance) influences another scale (e.g., macroscopic), while acknowledging that those elements, while out of scope or unavailable for direct inquiry at that time, were necessary involved in economic reasoning.

I want to suggest that it did not matter for the invisible hand’s success that no one example or definition can be given or agreed upon. The lack of precision or definition did not impede its role, on the contrary: it allowed the invisible hand to stand as a place-holder for elements that were logically necessary, yet not themselves under direct investigation- at least at that point in economics’ history. Lack of precision lead to at least one other known productive scientific concept. In her analysis of research programs in molecular genetics, Evelyn Fox Keller (2002) suggested that, in the case of genes, both the action and the entity doing the action were unknown and thus the word ‘gene’, and metaphors such as gene action or genetic program fulfilled a necessary role of offering labels and black-boxing out-of-reach research questions. This was a productive use of the metaphor, to the extent that it allowed research programs to be built on and pursued. I hopefully convinced you that the invisible hand metaphor’s success relied on very similar grounds: it gave a label to refer to a range of phenomena relevant to the scientific activity of economists.

References

Black, M. (1962). Metaphor in. Black, M. (1962). Models and Metaphors: Studies in Language and Philosophy. Ithaca, NY: Cornell University Press, pp. 25-47.

Burnett, D. G. (2009). Savage selection: analogy and elision in On the Origins of Species. Endeavour, 33, 120-125.

Grampp, W. D. (2000). What did Smith mean by the invisible hand?. Journal of Political Economy, 108(3), 441-465.

Keller, E. F. (2002). Making Sense of Life: Explaining Biological Development with Models, Metaphors, and Machines. Cambridge, MA: Harvard University Press.

Kennedy, G. (2009). Adam Smith and the invisible hand: From metaphor to myth. Econ Journal Watch, 6(2), 239-263.

McCloskey, D. N. (1995). Metaphors economists live by. Social research, 215-237.

Samuels, W. J. (2011). Erasing the invisible hand: Essays on an elusive and misused concept in economics. Cambridge University Press.

Smith, A. (1759). The theory of moral sentiments (Vol. 1976, p. 238). Oxford: Clarendon Press.

Smith, A. (1937). The wealth of nations [1776].

[1] A non-exhaustive list derived from this chapter (Samuels, 2011) includes the following: the market, price system, competition, choice in a market, profit motive, private enterprise, free enterprise, private property (« self-interest », « entrepreneurship »), « spontaneous-order principle and the principle of unintended and unforeseen consequences of Friedrich Hayek », « interactive adjustment process », game theory, intersubjectivity, natural selection, division of labor (specialization); propensity to truck, barter, and exchange; the faculties of reason and speech; self-interest; noneconomic foundations; commercial society as a particular stage in economic development, opportunity, and advantage; the nature and source of human nature; rhetoric in the service of social recognition and moral approbation, labor, consumer sovereignty, credit system, Walrasian auctioneer, capital accumulation, technology, positive externalities, historical process, final cause, nature, God, institutions. [2] « It has never been shown, however, that an economic invisible hand exists. Nor has it been shown that calling something the invisible hand adds anything to knowledge. » (Samuels, 2011, p. 76)

1 Comment

You must be logged in to post a comment.

Hal Morris 4 June 2020 (00:13)

Economic Sentiments

From looking at Smith’s 2-1/2 references to the invisible hand, I think he meant “Sometimes things work pretty well when you leave them alone”. It’s scandalous what a religion has been made of it.